WEBINAR ON DOUBLE TAX TREATIES IN AFRICA

PANEL DISCUSSION ON DTAS AND THE DIGITAL ECONOMY:

ADDRESSING CHALLENGES AND PROMOTING FAIRNESS IN INTERNATIONAL TAXATION

Date: 2 June 2023

Time: 2:15 – 3:15pm

Objective:

The panel aims to analyze the background and challenges related to double taxation in the context of the digital economy. It will explore the historical development of double taxation, the impact of new technology platforms, the responses of European nations and the United States, and the implications for Africa. The discussion will provide insights on how double tax agreements (DTAs) can be adapted to address the unique aspects of the digital economy while promoting global cooperation and effective taxation. The panel will cover topics such as the effects of cutting-edge technology on international trade, potential threats to tax sovereignty, and potential solutions to the challenges posed by double taxation in the digital economy. The objective is to identify key issues and propose practical solutions for navigating the complexities of double taxation arrangements in the digital economy.

Brief on the Topic:

The digital economy encompasses economic activities conducted through digital technologies and platforms, including e-commerce, online marketplaces, digital payments, cloud computing, big data analytics, and artificial intelligence. It has transformed business operations and interactions with customers, presenting both opportunities and challenges. As the digital economy has expanded, the issues surrounding double taxation have become more complex. Double taxation agreements need to be adapted to address the unique challenges posed by the borderless nature of the digital economy and intangible assets. Countries are exploring new measures and revising existing agreements to ensure fair and effective taxation of digital activities. Historically, double taxation agreements have evolved to facilitate international trade while minimizing the burden of double taxation. These agreements continue to adapt to technological advancements and changing dynamics in the global economy.

Some background to digital taxation issues

After WW1 the previous proposal of UK to have international taxation governed by place of central management was modified by the German concept of permanent establishment. Central management and control would privilege the exporters of capital (UK). A South African gold mine would be tax resident in UK because the owners/controllers met quarterly in UK for Board meetings! Germany was made up of many ‘states’ prior to unification and the issue of taxation arose in respect of traders operating across many states. They developed the concept of permanent establishment to capture those who had a permanent office or shop in the state and excuse those who simply arrived for ‘market days’ and similar.

After WW2, the new consensus was that international taxation would be governed by the two concepts of “permanent establishment” and “management and control “ and that market jurisdiction would be deprecated.

Each proposal tended to reflect the interest of the most powerful players and as power relations changed so did the consensus.

21st Century issues

Europe was used to being always on the side of the most powerful and was shocked to discover it was no longer. 2010 etc saw the development of ‘platfoms’ . These were dominated by US and China and Europe did not have an entry in the field. It became apparent once forward projections were made that platforms would dominate the consumer market. Under Covid the future arrived earlier than expected and 60% of all retail in UK was through platforms. Technically according to previous consensus platforms would not be tax resident in Europe and ALL the profits would escape European taxation. This they considered a disaster.

Europe’s response was to revert to market-based taxation models. These were the models they rejected in previous decades when argued for by developing countries.

Europe’s counterattack was focused on US platforms and attempted to bring them (Google, Amazon and Microsoft) under the hammer of European taxation. In order to make the attack on US platforms seem ‘objective’ they presented it as a proposal by the world as a whole so they create a discussion group headed by a Nigerian and including say 130 countries. The US saw this as ‘fig-leaf’ for an attack on the US platforms. Peter Barnes was dead set against Pillar 1 and President Trump was persuaded to tear up the first proposal.

The US position is that if the rest of the world wants to adopt OECD proposal so be it they will not. America accepts that their platforms will pay some overseas including European tax. However, it is Europeans who wish to ensure Africa gets NONE of this. The US has no objection to Africa getting a fair share of the pie. Africa has failed to identify that it should ally with the US to ensure we either get a better deal or do a deal direct with the US. Since the platforms are US based Africa could easily begin negotiating direct with the US.

Europe’s proposals are an attempt to tie the hands of Africa in advance of the new developments that are expected. In return for giving up their sovereignty they are given weak promises of maybe more money. Pillar 1 requires promises not to introduce new legislation which not only violates tax sovereignty but is aimed at making responses to new developments impossible.

In order to achieve their purposes, the OECD engaged in misdirection and presenting their proposals as attempts to benefit the whole world. Once the OECD proposals are looked at in the light of future developments, they will appear truly cynical and predatory.

Led by Nigeria, the Africa Group of 54 member states at the UN, proposed a new UN Tax Convention and the establishment of a new global tax body. A last-minute amendment from the United States that such a body would undermine the OECD’s efforts was rejected. “Shifting power from the OECD is paramount to end the exploitation and plunder of developing countries”, according to a spokesperson for the Global Alliance for Tax Justice.

Foreign Policy, a major US journal, in a piece entitled ‘Will the UN Tax Convention empower Africa’ (see references), interviewed Peter Barnes, President of IFA, who explained: ’The Pillar One exercise is not likely to succeed’.

Nigeria’s leading role in bringing African countries together to oppose the OECD is to be applauded. Nigeria’s actions have been supported by many other countries in the Global South. Latin America and other regions, according to Foreign Policy, are seeking to replicate the African initiative. This confirms the correctness of Nigeria’s decision to include South America (Brazil, Columbia) , and Asia (India and China) in our Africa Research Group.

MEET THE PANELISTS

Moderator:

Ifueko M Omoigui Okauru – Managing Partner, Compliance Professionals Plc –

Ifueko.omoigui.okauru@complianceprofessionalsplc.com

Speakers:

Peter Barnes – President of the International Fiscal Association (“IFA”) and International Tax Advisor, Caplin & Drysdale – pbarnes@capdale.com

Lolade Ososami – Partner, Udo Udoma and Belo-Osagie – lolade.ososami@uubo.org ; loladeososami@yahoo.co.uk

Mr. Kajesomo V. Kehinde – Deputy Director/Head Treaties & International Tax Policy Division, Tax Policy and Advisory Department, Federal Inland Revenue Service – kajesomo.kehinde@firs.gov.ng

Tatiana Falcao – Senior Policy Expert in International Tax – tatiana.falcao@yahoo.com.br

PANELIST BIOGRAPHIES

Peter Barnes

Peter Barnes is an experienced tax advisor specializing in global tax planning programs for multinational corporations. With over 20 years of experience as Senior International Tax Counsel for GE, about 10 years of experience at Caplin & Drysdale, and a background in government roles, he offers strategic solutions to complex tax issues. Additionally, Barnes serves as a Senior Fellow at the Duke Center for International Development (DCID) at Duke University. He is actively involved in teaching at Duke’s International Tax Program, which is jointly directed by DCID and Duke Law School.

After serving as Senior International Tax Counsel for General Electric Co. (“GE”) for more than 22 years, Peter Barnes joined Caplin & Drysdale as Of Counsel to the firm’s International Tax Group in 2013. His extensive experience of over 30 years in the international tax arena adds significant value to the firm and its clients. In November 2021, Barnes was elected as the President of the International Fiscal Association (IFA). He continues to share his knowledge and expertise as a Senior Fellow at the Duke Center for International Development (DCID) at Duke University. At Duke, he teaches in the International Tax Program, which is jointly directed by DCID and Duke Law School. Barnes also directs an annual week-long transfer pricing workshop for government tax officials and private sector advisors, with participants from many developing countries. In 2015, he was elected as the U.S. delegate to the Permanent Scientific Committee of the IFA, where he played a crucial role in supervising the planning and implementation of the scientific work of IFA.

Prior to his tenure at GE, Barnes served as the U.S. Deputy International Tax Counsel at the U.S. Treasury Department’s Office of Tax Policy. In this role, he represented the U.S. government in treaty negotiations and acted as a delegate to the Organization for Economic Co-operation and Development (OECD). During his career at the U.S. Treasury, Barnes played a key role in implementing guidance stemming from the Tax Reform Act of 1986.

Lolade Ososami

Lolade Ososami is an experienced lawyer with expertise in taxation, mining, oil & gas, and foreign investment and Partner at the law firm of Udo Udoma, Belo Osagie & Co. She has a strong background in commercial law practice in Nigeria, the largest emerging market in Sub-Saharan Africa. With her in-depth understanding of the legal and regulatory framework for international investment in the region, she provides advisory services on diverse domestic and cross-border commercial transactions across various sectors. Her clients include multinational corporations, investment funds, oil & gas companies (upstream and downstream), banks and other financial institutions, as well as senior executives of corporate organizations. Her practice areas of focus include international tax, corporate restructuring, debt and equity financing, and tax disputes.

Lolade Ososami is a member of notable professional associations, including the Nigerian Bar Association, International Bar Association, and International Fiscal Association. She has authored publications on topics such as BEPS Action Implementation, transfer pricing compliance, and BEPS in Nigeria and its implications for cross-border taxation.

Kehinde Victor Kajesomo:

Kehinde Victor Kajesomo is a highly experienced tax practitioner and administrator with specialization in International Taxation. He has a distinguished career spanning more than 22 years in the banking industry and tax administration.

As a Fellow of both the Institute of Chartered Accountants of Nigeria (ICAN) and the Chartered Institute of Taxation of Nigeria (CITN), Kehinde serves as the Deputy Director and Head of the Treaties and International Tax Policy Division of the Tax Policy and Advisory Department at the Federal Inland Revenue Service (FIRS). He plays a pivotal role as the lead negotiator of the technical team responsible for negotiating tax treaties for Nigeria.

Kehinde represents Nigeria in important international forums such as the UN Subcommittee on Tax Treaties and the OECD Steering Group of the Inclusive Framework on BEPS (SGIF). He is actively involved in various working parties related to tax treaties, transfer pricing, aggressive tax planning, and the digital economy. Additionally, he participates in the Tax Force on Digital Economy (TFDE), the Forum of Tax Administration on Mutual Agreement Procedure (FTA MAP), and the Conference of Parties to the MLI, among many other international meetings and groups dedicated to developing policies and rules on international tax-related issues. Kehinde also serves as a member of the African Tax Administration Forum (ATAF)’s Tax Treaties Mentorship Group, providing technical assistance to African countries in tax treaty negotiations and implementation.

Throughout his career, Kehinde has facilitated numerous courses, seminars, and workshops on International Taxation, Tax Treaties, Transfer Pricing, the Digital Economy, and other tax-related subjects. He has organized these events in collaboration with FIRS and other bodies, both locally and internationally.

Tatiana Falcão:

Tatiana Falcão is a distinguished expert in international tax, with a focus on environmental taxation. She currently leads the environment and tax portfolio under the Tax and SDGs program at the United Nations Development Programme (UNDP). Tatiana’s expertise is sought after by prestigious organizations such as the World Bank, IMF, and the African Tax Administration Forum (ATAF), where she provides services in the field of international tax.

Tatiana played a crucial role as a founding member of the United Nations Subcommittee on Environmental Taxation. She is also a member of the Scientific Committee of the Africa Tax Research Network (ATRN) of ATAF. In her previous roles, Tatiana served as the Coordinator for Helsinki Principle 3 (carbon pricing) at the Coalition of Finance Ministers for Climate Action, hosted by the World Bank. She also held managerial positions at the U.N. Environment Program (UNEP), where she managed the Green Fiscal Policy Network, and at U.N. DESA, overseeing the work of the Committee of Experts in International Cooperation in Tax Matters.

Tatiana’s research primarily focuses on the intersection of international tax law and policy issues, with a particular emphasis on the impact on emerging economies. Her book titled “A Proposition for a Multilateral Carbon Tax Treaty” was published by the IBFD in 2019. She is a columnist at Tax Notes International and a frequent contributor to the Kluwer International Law Tax Blog. In 2019, Tatiana was recognized by the Women in Tax Committee of the International Fiscal Association (IFA) as one of the top 40 women lawyers who have shaped international taxation over the last 100 years.

Tatiana holds a Ph.D. from the Vienna University of Economics and Business (AU), an LL.M. from the University of Cambridge (UK), where she also served as the editor and treasurer of the Cambridge Law Review, and an LL.M. from New York University (USA). She completed her bachelor’s degree in law cum laude at Universidade Candido Mendes (BRA).

Ifueko M Omoigui Okauru, MFR:

Ifueko M Omoigui Okauru is a highly accomplished professional with expertise in chartered accountancy, chartered tax practice, and management consulting. She holds degrees from the University of Lagos, Nigeria, Imperial College London, and Harvard Kennedy School. As the co-founder and CEO of Compliance Professionals Plc, Nigeria, she actively engages in research and initiatives aimed at positioning Nigeria for greatness.

Mrs. Okauru serves on three public boards in Nigeria, namely Nigerian Breweries Plc (non-executive director), PZ Cussons Nigeria PLC (Chairman), and MTN Nigeria Telecommunications Plc (Non-Executive Director). She also chairs the boards of Afyacare, a health investment firm, ReStraL Ltd, a management consulting firm that she founded in 1996, the DAGOMO Foundation Nigeria (Limited by Guarantee), a family-based social enterprise; as well as Chair of the Nigeria Tax Research Network.

During her tenure as the Executive Chairman of the Federal Inland Revenue Service (FIRS) of Nigeria from May 2004 to April 2012, Mrs. Okauru led significant tax reforms and modernization efforts in the Nigerian tax administration system. Under her leadership, comprehensive tax reforms were implemented, including the development of a national tax policy and the modification of nine principal tax legislations, with five of them passed into law and the development of an international tax practice within the Service. She spearheaded the negotiation of double taxation agreements, overhaul of tax statutes and development of supportive regulations, as well as the re-engineering and automation of tax administration processes. Her initiatives resulted in visible improvements in tax administration, substantial growth in tax revenues (both oil and non-oil), increased awareness among the populace about their tax obligations, and enhanced staff motivation.

In addition to her achievements at FIRS, Mrs. Okauru served as a part-time member of the United Nations (UN) Committee of Experts on International Cooperation in Tax Matters from August 2009 to July 2013; chairing the sub-committee on Capacity Building. She was also a member of the Nigerian President’s Economic Management team and the National Stakeholders Working Group of the Nigeria Extractive Industry Transparency Initiative (NEITI). Mrs. Okauru holds the distinction of being the first female Executive Chairman of FIRS and the first female Chairman of the Joint Tax Board of Nigeria. She has received several awards for her distinguished service to Nigeria, including the national honor of Member of the Federal Republic (MFR).

Lyla Latif, PhD

Lyla Latif is an Advocate of the Courts of Kenya specialised in corporate, tax and transactions law. She is also an academic whose work focuses on steering legal and tax systems to reinforce the use of public finances towards redistribution. She investigates emerging tax norms and rules, political commitments, bilateral and multilateral agreements, FDI, regional cooperation, revenue mobilisation strategies, artificial intelligence and technology to evaluate what opportunities and threats emerge for Africa’s fiscal space and towards enhancing transparency to detect and constrict the enabling environments that could potentially foster illicit financial flows out of these.

She was one of the panelists at the IFA WEBINAR ON DOUBLE TAX TREATIES IN AFRICA

Panel Discussion on Abuse of Tax Treaties: Addressing Challenges and Promoting Fairness in International Taxation

by Layla Latif, PhD

Objective:

The objective of this panel discussion is to facilitate a comprehensive and insightful dialogue on the abuse of tax treaties, its implications, and potential solutions. The panel aims to engage tax practitioners, lawyers, academics, civil society representatives, and government officials to collectively address the challenges associated with treaty abuse and explore avenues for promoting fairness in international taxation.

Briefing on the Topic:

Tax treaties play a crucial role in regulating cross-border taxation, ensuring fair allocation of taxing rights between countries, and promoting economic cooperation. However, there has been growing concern about the abuse of tax treaties, wherein taxpayers exploit the provisions of these treaties for purposes contrary to their intended objectives.

Abuse of tax treaties encompasses practices such as treaty shopping, artificial avoidance of permanent establishment status, and improper use of tax treaty benefits, resulting in erosion of the tax base, revenue loss for countries, and an unequal distribution of tax burdens. Such abusive practices undermine the principles of tax fairness, transparency, and cooperation among nations.

Addressing treaty abuse requires a multi-dimensional approach involving legal, policy, and administrative measures. It necessitates a collaborative effort among tax professionals, legal experts, policymakers, and civil society stakeholders to develop effective strategies and reinforce international tax rules to prevent abuse, close loopholes, and ensure a fair and equitable international tax system.

Proposed Questions to be Tackled:

Understanding the Scope and Nature of Treaty Abuse:

- What are the key forms and mechanisms of treaty abuse prevalent in the current international tax landscape?

- How does treaty abuse impact national tax systems, economic development, and revenue mobilization efforts?

Legal and Policy Frameworks to Combat Treaty Abuse:

- What legal and policy measures can be adopted at the national and international levels to counter treaty abuse effectively?

- How can countries strengthen anti-abuse provisions in tax treaties and domestic legislation while maintaining a balance between combating abuse and facilitating legitimate cross-border transactions?

Enhancing Administrative Capacity and Cooperation:

- What steps can tax administrations and authorities take to detect and prevent treaty abuse effectively?

- How can international cooperation, information exchange, and collaboration among tax authorities be enhanced to address treaty abuse challenges?

Balancing Tax Competition and Fairness:

- How can countries strike a balance between maintaining competitiveness and preventing abusive tax practices?

- What role can tax policy play in reducing the incentives for treaty abuse and ensuring a level playing field for taxpayers?

Role of Civil Society and Public Awareness:

- How can civil society organizations, academia, and the public contribute to raising awareness about treaty abuse and advocating for policy changes? The role of TJNA in challenging DTAs.

- What role can research and academic studies play in informing policy debates and promoting transparency in international taxation?

Through this panel discussion, we aim to generate a rich exchange of ideas, experiences, and perspectives from diverse stakeholders. By analysing the challenges, exploring solutions, and fostering collaboration, we hope to contribute to the development of practical recommendations and initiatives that mitigate treaty abuse and support fair and efficient international tax systems.

Reference material:

Mechanisms to fight treaty abuse: An overview

TJN Africa takes Kenya government to court over Mauritius treaty

Topic 3: Abuse of Tax Treaties: Addressing Challenges and Promoting Fairness in International Taxation

Frances Kairu, Policy Advisor, Tax Justice Network

Dr. Lyla Latif, Advocate and Academic at University of Nairobi

Stephen Shay, Senior Tax Fellow, Boston College Law School

Abuse of Tax Treaties: Topics

- Understanding the Scope and Nature of Treaty Abuse

- Legal and Policy Frameworks to Combat Treaty Abuse

- Enhancing Administrative Capacity and Cooperation

- Balancing Tax Competition and Fairness

- Role of Civil Society and Public Awareness

Scope and Nature of Treaty Abuse: Background

- A MNE taxpayer’s tax objective is to minimize its global effective tax rate, irrespective of the country to which tax is paid.

- Treaties are just one of a panoply of tools to reduce tax.

- Treaties are used in combination with deductible payments (interest, royalties, management fees), hybrid transactions (instrument and entity classifications), inconsistent permanent establishment (PE) and source rules, and offshore capital gains to avoid or reduce source taxation. Transfer pricing is the source of or increases the benefits.

- One of three answers every international problem: (i) use a hybrid, (ii) transfer pricing, (iii) write a derivative. Or in combination.

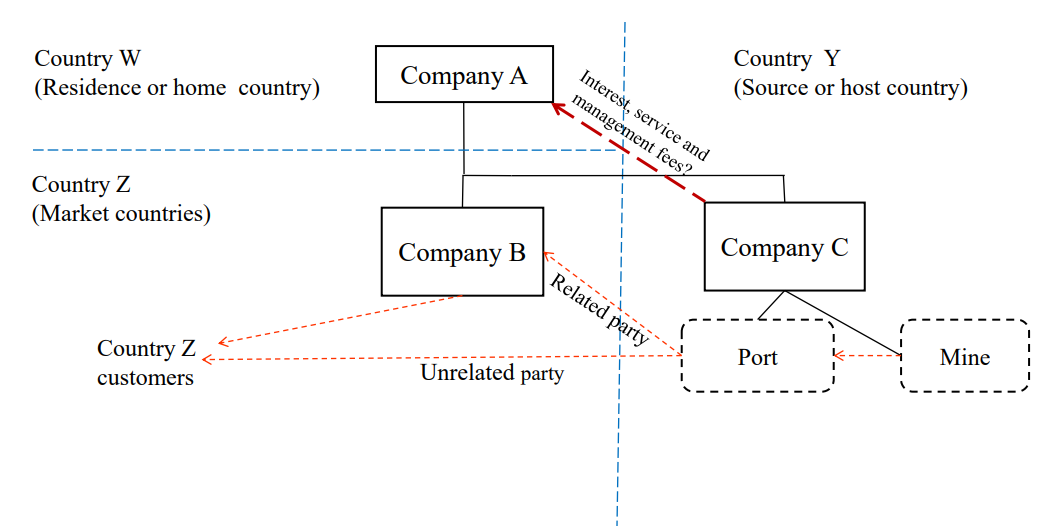

Example 1A – Base Case

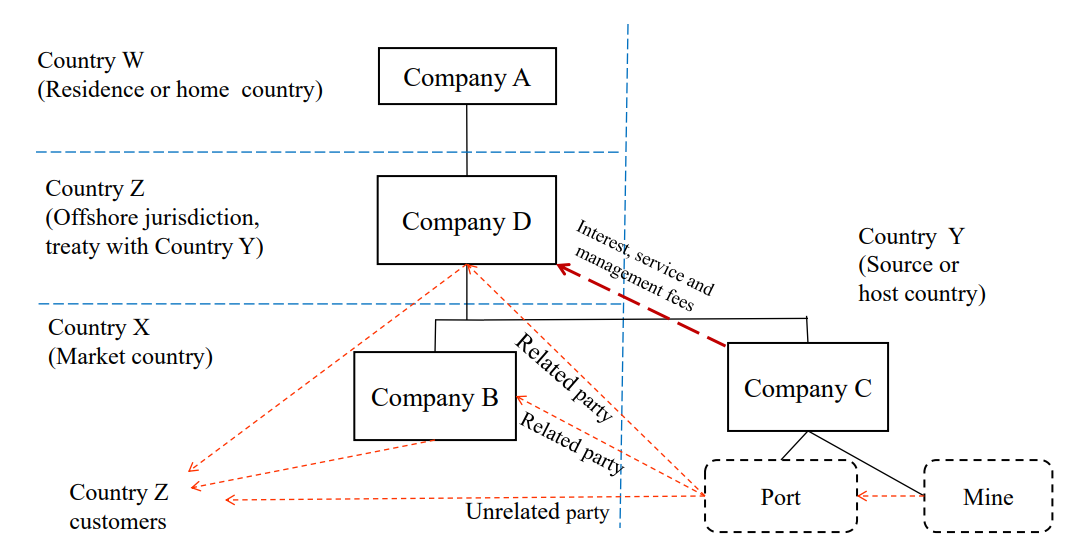

Example 1B – Offshore Treaty Company

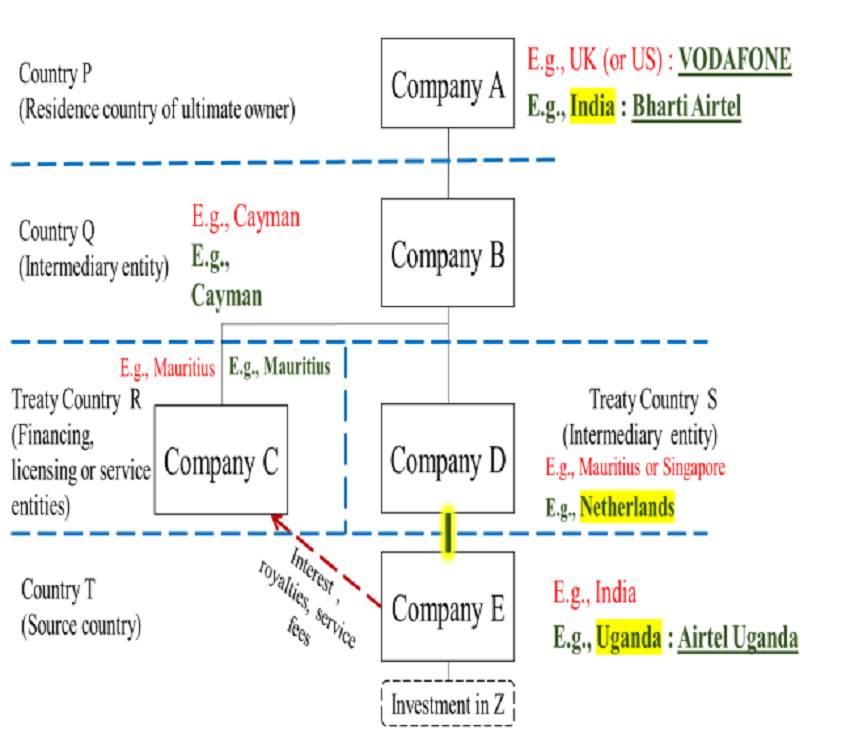

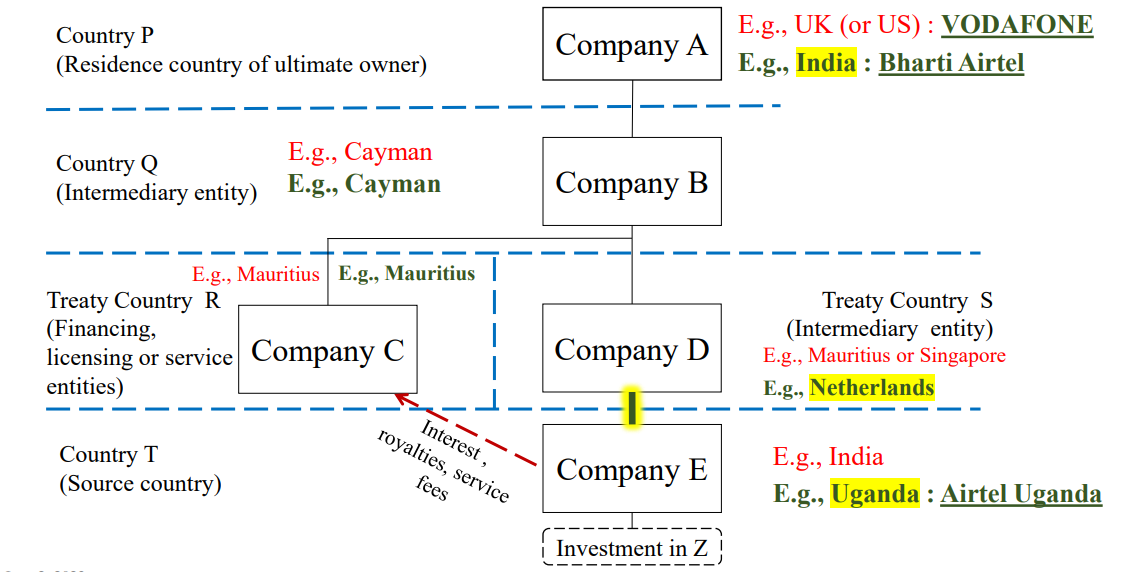

- Pre-BEPS and MLI it would be typical for a structure like the diagram to be used to make an equity direct investment financed with debt through a financing entity.

- Cash can be repatriated through principal repayment on intercompany debt.

- Base erosion is through interest, royalties and fees. Withholding taxes on interest and royalties are reduced by treaty. Fees depend on whether there is technical services article or PE.

- This structure permits multiple exit structures: A sells B; B sells D; D sells E.

- What effect Pillar 2?

Legal and Policy Frameworks to Combat Treaty Abuse: Country Best Practices

- Always consider treaties in and as a network. A country’s treaty network only is as strong as its weakest treaty.

- At least 4 countries involved in both examples above

- Identify aggressive tax treaties in a network:

- Such as Mauritius and the Netherlands

- Systemic tax treaty network review must go beyond dividends:

- Include interest, royalties, technical fees and combinations!

- Treaties lose revenue. Why have treaties? Rigorous cost benefit analysis is required.

Sources: Hearson (23 Sept 2014), Oxfam (1 Oct 2020), Van ‘t Riet & Lejour (1 Oct 2020), Volkskrant (27 Nov 2020), ICTD WP 125 (Nov 2021)

Legal and Policy Frameworks to Combat Treaty Abuse: Possible Approaches:

- Domestic law anti-abuse rules/doctrines

- Relationship of domestic law anti-abuse rules to treaties

- GAARs, business purpose and economic substance doctrines, substance over form, anti-conduit rules, and the like.

- What role for international law doctrines taking account of the object and purpose of tax conventions as well as the obligation to interpret treaties in good faith under Article 31 of the Vienna Convention on the Law of Treaties?

- Treaties (with and without amendment under the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (or MLI) and treaty rules to prevent abuse:

- Residence rules

- Beneficial ownership condition

- Limitation on benefits provisions:

- Objective rules: Testing persons; equivalent benefits tests.

- Testing items of active business income

- Principal purpose test (PPT) rules

- Dispute resolution mechanisms – arbitration or not?

- Competent authority rulings.